Generics Unleashed: Jardiance Patent Expiry Rocks India’s Pharma Scene

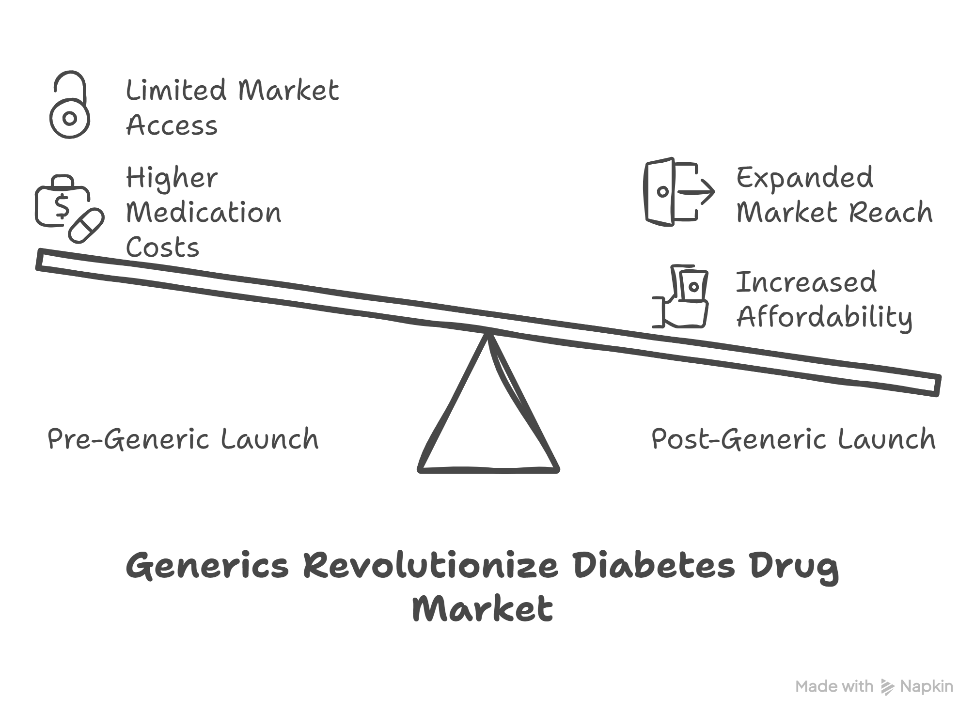

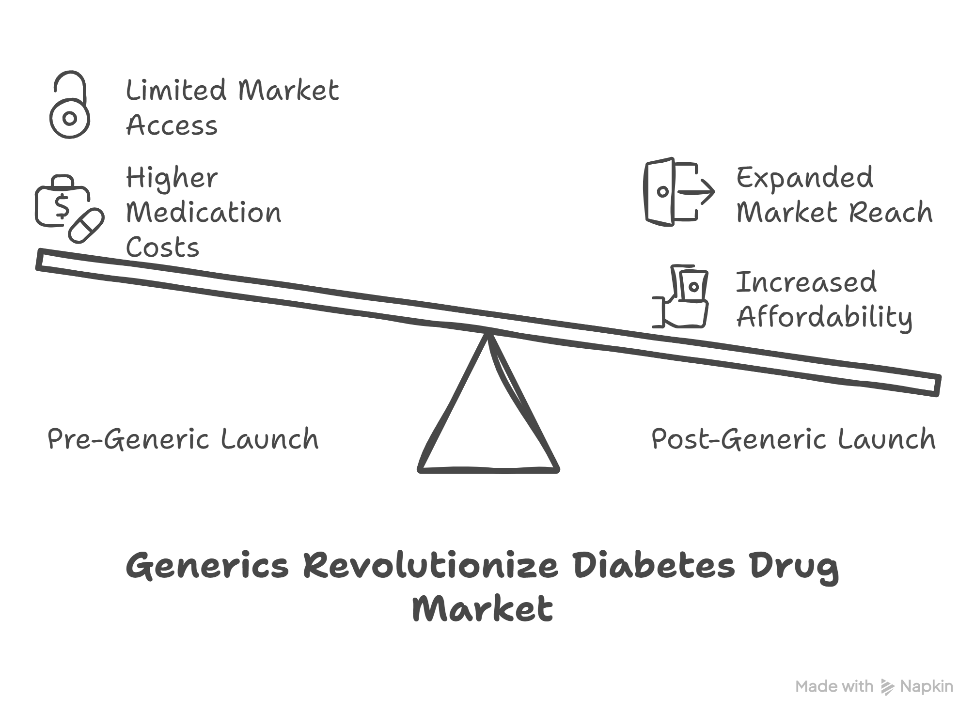

March 11th, 2025, marked a seismic shift in India’s pharmaceutical landscape. With the patent expiry of Jardiance (empagliflozin)—a blockbuster anti-diabetic drug originally developed by Boehringer Ingelheim—the gates opened for generic manufacturers to enter the market. And enter they did, in full force.

Almost overnight, major Indian pharmaceutical players such as Mankind Pharma and Lupin rolled out their own versions of empagliflozin. The impact was swift and dramatic: prices plunged from around ₹60 per tablet to a highly affordable ₹9–₹14. For India’s ₹3,235 crore anti-diabetes drug market, this was nothing short of revolutionary.

A Win for Public Health

Jardiance isn’t just any diabetes drug. Its role extends beyond blood sugar control—it’s also used to manage Type-2 diabetes, heart failure, and chronic kidney disease. The sudden availability of low-cost alternatives is a huge boost for patients, especially in a country where affordability often dictates access to life-saving medication.

This shift ensures that millions of patients now have broader access to a drug that can significantly improve quality of life—and even extend it.

Strategic Moves by Indian Pharma

The response from Indian companies wasn’t just fast; it was strategic.

- Torrent Pharmaceuticals made a forward-looking move by acquiring branded empagliflozin products in December 2024, positioning itself strongly in a post-patent marketplace.

- Lupin, meanwhile, went a step further by securing trademark rights for some of its most well-known anti-diabetes brands—an indicator of how branding continues to matter even when exclusivity fades.

These moves highlight a key trend: the growing importance of brand identity and lifecycle management in the Indian pharma sector. As patent cliffs become more frequent, companies are innovating beyond molecules—focusing on marketing, packaging, and public trust.

Implications for India’s Patent Ecosystem

The Jardiance episode offers a fascinating look into the delicate balance between innovation protection and public health imperatives.

On one hand, patents are crucial to incentivize innovation. But once they expire, they pave the way for generic entry—essential for increasing affordability and access. India’s pharmaceutical industry, known for its manufacturing agility, was quick to capitalize on this opportunity.

For originator companies, the lesson is clear: rely less on patent protection alone. Going forward, we can expect increased focus on:

- Secondary patents (e.g., for new formulations or combinations)

- Brand loyalty and physician relationships

- Market differentiation strategies

What’s Next?

Jardiance won’t be the last blockbuster drug to go off-patent. As we move into an era where many high-value drug patents are approaching their end, India’s pharma sector is poised to play a leading role in generic innovation and global medicine access.

Industry watchers are already keeping an eye on future expiries like:

- Ozempic (semaglutide)

- Keytruda (pembrolizumab)

- Xarelto (rivaroxaban)

Each of these could trigger similar market transformations, reshaping both pricing structures and access to treatment.

Conclusion

The expiry of Jardiance’s patent is more than just a date on a calendar—it’s a defining moment in India’s pharma journey. It highlights how the intersection of innovation, accessibility, and strategic branding will shape the future of healthcare not just in India, but globally.

As generics rise and prices fall, millions stand to benefit. And for India’s homegrown pharmaceutical giants, the road ahead looks full of opportunity.